APAC’s Top 20 banks’ combined revenue up 4.3% in 2023

Japanese banks were the biggest winners whilst Chinese banks’ total revenue dipped.

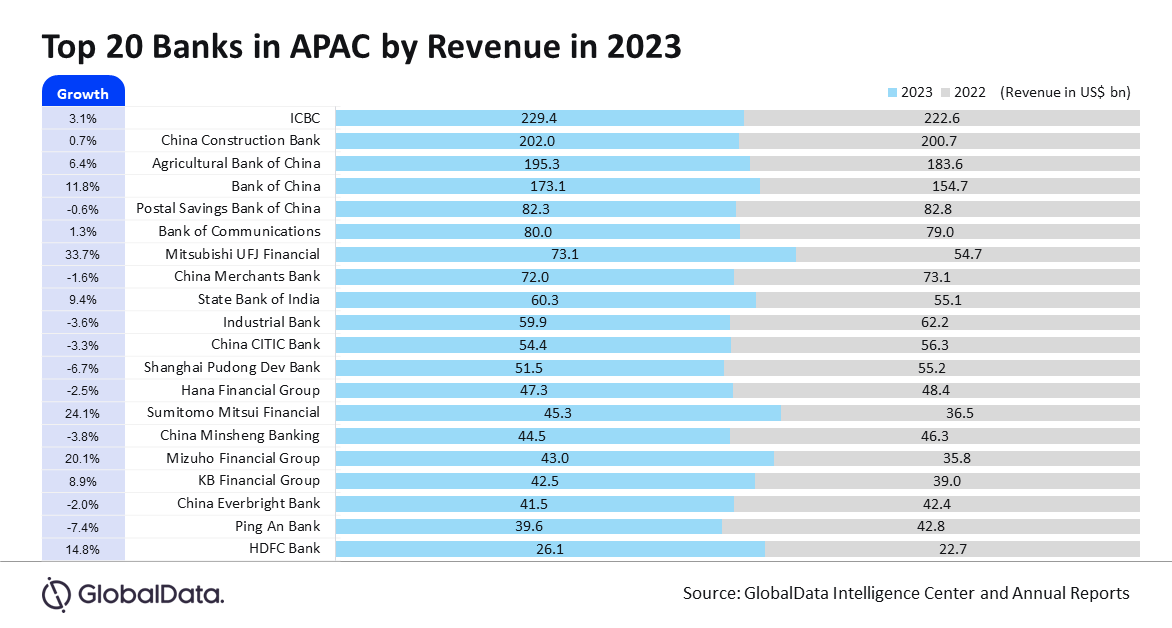

The 20 banks in Asia Pacific (APAC) who earned the most in 2023 saw their combined revenue rise by 4.3% over the year, according to a report by data and analytics company GlobalData.

Combined revenue reached $1.67t in 2023, up from $1.6t in the previous year, fuelled by a surge in interest income.

However, they also suffered from a decline in non-interest income amidst economic volatility and heightened competition.

Of the 20 banks, 13 were from China. On average, Chinese banks reported a revenue decline of 0.4% year-on-year, on the back of weak credit demand and the real estate crisis, said Murthy Grandhi, company profiles analyst at GlobalData.

Japan’s big three– Mitsubishi UFJ Financial (MUFJ), Sumitomo Mitsui Financial, and Mizuho Financial Group– were the only banks in the top 20 to record more than 20% revenue growth in 2023.

MUFJ’s revenue grew by 33.7% on the back of its interest income more than doubling (104.8% growth) in 2023. This was mainly due to the gains on cancellations of investment trusts, improvement in loan spread, and an increase in earnings from foreign deposits, GlobalData said.

Sumitomo Mitsui Financial, meanwhile, recorded a 24.1% growth in revenue due to the depreciation of yen, an increase in interest income, and an increase in fees and commissions.

Mizuho Financial Group logged a 20.1% increase in revenue, which GlobalData said was thanks to a 99.5% rise in interest from loans and bills.

Bank of China was the top Chinese Bank in terms of revenue growth. Revenue grew by 11.8% as a result of higher loans and advances to customers, and rising interest rates.

In contrast, Ping An Bank was named the worst performer in the top 20, with interest income declining by 0.6% and non-interest income falling by 10.9% in 2023, according to GlobalData.

Looking ahead, the performance of APAC banks in 2024 will likely hinge of economic growth in key economies such as China and India and regulatory changes.

“Central banks’ decisions regarding interest rates will impact net interest margins and loan demand. Regulatory changes, including adjustments to capital requirements, will shape banks’ profitability and operational strategies,” Grandhi said.

Grandhi warned that ongoing geopolitical tensions and trade relations may introduce volatility and negatively impact economic activities in APAC.

“Maintaining credit quality and managing non-performing loans will be critical for banks’ financial health amid potential economic downturns,” he concluded.

GlobalData