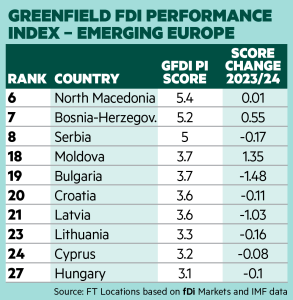

Greenfield FDI Performance Index 2025 – North Macedonia leads emerging Europe pack

Energy investment shored up FDI in the western Balkan country last year.

North Macedonia is the highest-ranking country in emerging Europe in this year’s reading of the Greenfield FDI Performance Index, ranking sixth overall.

With a population of less than 2mn inhabitants and a nominal 2024 GDP of about $16bn, the western Balkan country is a case in point of a nation punching above its weight when it comes to attracting foreign direct investment.

The country has traditionally received FDI in manufacturing and business services, but 2024 saw a new major investment in the energy sector that could deepen its investment potential in the years to come. Dubai-based renewable energy fund Alcazar Energy announced a 400MW wind farm in Stip, 75km south of capital city Skopje in June last year. Total investment is expected at $500mn.

The project has reached ready-to-build stage and is expected to kick off towards the end of the year once Alcazar finalises its project financing, co-founder and managing partner Daniel Calderon tells fDi Markets.

With a capacity factor in the high 20s, Calderon says that “with Macedonia’s wind resources and the region’s cost of capital, projects like this can already reach break-even at around half of current wholesale power prices”. Wholesale prices in the western Balkans averaged roughly €140/MWh in the first quarter of 2025. “This underlines the economic case for renewables in the region.”

The project would not only prove the feasibility of FDI into the country’s renewable energy sector — a few other projects in wind and solar were announced in the past, but none are operational yet. It would also boost the country’s sustainability agenda and energy security, as the country produces 40 per cent of its power from coal and remains a net importer of electricity, according to figures from the International Energy Agency. By doing so, it would upgrade the whole economy and its exports sectors, also in light of the upcoming EU Carbon Border Adjustment Mechanism.

“Our focus has moved away from low-cost, labour-intensive projects to high value-added and capital-intensive sectors — particularly in automotive components, medical devices, shared services, IT, and renewables,” Timcho Mucunski, the country’s minister for foreign affairs and foreign trade, tells fDi.

“North Macedonia is no longer focused solely on volumes — it is strategically directing FDI towards structural transformation. The goal is to build a more inclusive and resilient economy by linking foreign investors with domestic suppliers and accelerating local value creation.”

A key element of the country’s FDI proposition is its Nato membership, which elevates its geostrategic value, effective from 2020, and its ongoing integration with European Union infrastructure such as energy and transport corridors. Wider accession talks with the EU officially started in 2022.

But the country still has ground to cover when it comes to upgrading its labour force and reforming its economy and institutions.

“Education reform, infrastructure development, and stronger governance will be key to sustaining this momentum,” concludes Mucunski. “The government’s mid- to long-term vision is to support domestic companies in becoming competitive partners in the global supply chains of multinational investors operating in the country.”

fDi Markets