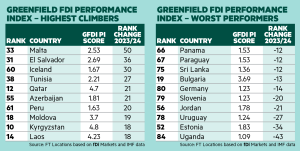

Greenfield FDI Performance Index 2025-Top risers and fallers

Malta was the biggest improver, while Uganda lost the most ground.

Malta is the highest climber in the 2025 edition of the Greenfield FDI Performance Index, jumping 50 places from last year to rank 33rd overall.

It is one of several smaller nations to climb the ranking. El Salvador, Iceland, Moldova, Kyrgyzstan, Laos and Namibia are also among the biggest improvers.

In part, this is due to these countries having small economies and a relatively small volume of inbound foreign direct investment projects, which amplifies the impact of changes in the annual FDI project count.

Yet these countries are also showing improved offerings for foreign companies. For example, most FDI projects into Malta cite the ability to serve the EU market as a key driver, figures from greenfield investment monitor fDi Markets show.

While most inward FDI into Malta is service-based, Turkish industrial company, Gimas, announced plans to establish a $7.5mn subsidiary to produce wind turbine components, proving the country’s capabilities to attract FDI across a range of sectors.

Several notably larger FDI players such as Qatar (up 21 places), Canada (up 17), and Thailand (up seven), also rank among the most improved performers. Canada achieved a score of 1.51 — its highest in the index’s 10-year history. While Canada’s share of global GDP has remained relatively stable, 2024 marked a record year for inbound FDI project volumes, fDi Markets figures show. Although growth was observed across most sectors, industrial equipment, communications and electronic components stood out as key drivers of the surge in project volumes.

Strong growth in inbound FDI projects in Qatar and Bahrain has seen both countries enter the top 15 overall. Qatar’s inbound project numbers almost doubled in 2024 from a year earlier, according to fDi Markets. In the same period, FDI into Bahrain grew by almost 50 per cent. Business services and tech remain key sectors in Qatar, however there was notable growth in consumer products and textiles FDI.

Sitting on the opposite edge of the results spectrum, Uganda is this year’s biggest faller.

The east African country falls 43 places as its number of inbound projects dropped, and its GDP grew by 8.7 per cent.

Similarly, Germany — one of the world’s leading FDI destinations — falls 14 positions. Germany’s economy has struggled to grow in recent years. After Russia’s invasion of Ukraine in 2022, Germany experienced high inflation as its dependence on Russian energy became evident. These macro issues weighed on investor sentiment, with inbound FDI projects falling in 2024 to their lowest level in 10 years, according to fDi Markets.

The German government has since introduced a range of fiscal measures, such as a €46bn tax relief package and a €500bn infrastructure investment plan, to stimulate growth. The potential positive impact of this may already be seen with its latest balance of payments receipts showing net foreign investment in Germany steering upward.

fDi Markets