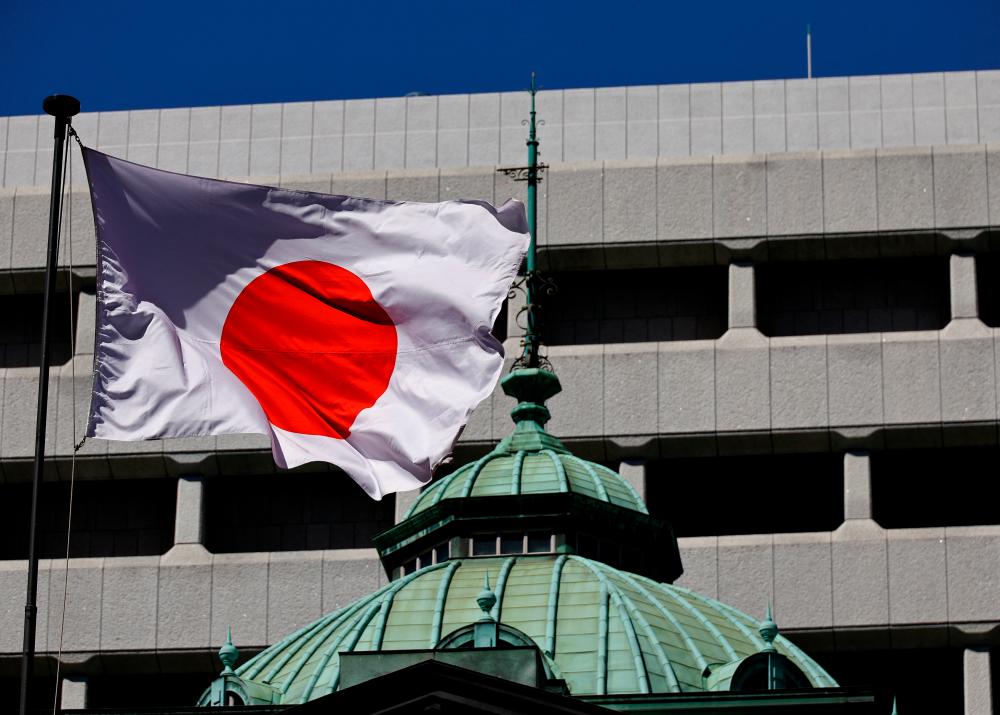

Bank of Japan keeps rates steady, raises growth and inflation forecasts

The central bank vowed to raise rates if economic and price developments move in line with its projections.

The Bank of Japan raised its growth estimate and maintained its hawkish inflation forecasts on Friday even as it kept interest rates steady, signalling its confidence a moderate recovery would justify raising still-low borrowing costs further.

In a sign of its caution over the inflationary effects of a weak yen, the central bank said the currency’s moves could prod firms to pass on rising import costs and push up underlying consumer prices – a key gauge determining its rate-hike timing.

Board member Hajime Takata also proposed raising rates for the second straight meeting, which found no other voices in support but highlighted the hawkish momentum within the central bank.

At a two-day meeting that ended on Friday, the BOJ maintained its key policy rate at 0.75 per cent in a widely expected decision after having just hiked the rate from 0.5 per cent in December.

In a quarterly outlook report, the BOJ raised its growth forecast for fiscal 2025 and 2026, and maintained its view the economy will remain on course for a moderate recovery. It also revised up its core consumer inflation forecast for fiscal 2026 to 1.9 per cent from 1.8 per cent three months ago, adding that risks to the economic and price outlook were roughly balanced. “The mechanism in which wages and prices rise moderately in tandem will be sustained, allowing for underlying inflation to continue rising moderately,” the BOJ said in the report.

Markets are focusing on Governor Kazuo Ueda’s post-meeting press conference for hints on when the BOJ might next raise rates, a decision complicated by a fresh bout of market volatility caused by Prime Minister Sanae Takaichi’s decision to call a snap election next month.

“After its hike in December, it is no surprise that the BOJ remained on hold today. However, the central bank’s outlook report hints at growing hawkishness, with officials revising up their growth forecasts for the coming year and, crucially, also nudging up their inflation expectations for the next couple of years,” said Fred Neumann, chief Asia economist at HSBC in Hong Kong.

“Governor Ueda in his remarks will likely lean into a more hawkish direction, which may keep the next meetings ‘live’ for a further policy rate hike,” he said.

The BOJ painted a more optimistic view of the economy from three months ago, adding in the report that a positive cycle of income and expenditure will “gradually strengthen.”